Bitcoin is much more than a store of value

The implications for ownership, governance, and the distribution of wealth in an economy powered by crypto-economic incentives

Over the past few months, Bitcoin has re-emerged as a hot topic across mainstream media outlets, appearing in Wall Street Journal headlines and as a frequent topic of debate on CNBC. Most discussions have focused on the assets’ price, which has risen to recent highs above $40,000, or on the store-of-value thesis driving most institutional purchases.

But when it comes to why Bitcoin’s emergence is so exciting, the journalists and news anchors have missed the point. I’m far less excited about bitcoin’s properties as an investment than I am about its ability to incentivize behavior on a global scale, and what this represents for our economy.

Bitcoin has gained traction as an attractive store of value due to the fact that it is, in the words of legendary investor Paul Tudor Jones, “literally the only large tradeable asset in the world that has a known fixed maximum supply”. [1]

From where does this property emerge? A set of specialized computers, otherwise known as miners, work around the clock to enforce the rules written into Bitcoin’s underlying software. They properly order current transactions, verify historical ones, protect against double-spends, and enforce the rules of supply. Encoded into the rules is a maximum supply of 21 million bitcoin.

Doing this work is expensive, but the miners do not labor for free. The miners are working in exchange for a probabilistically guaranteed bitcoin-denominated reward, earned whenever the miner successfully adds a block of transactions to the chain.

Critically, there are also disincentives to malicious behavior. The biggest threats to Bitcoin’s trustworthiness arise when a miner has gained more than half of the network’s total compute power. However, for this hypothetical miner, it is “... more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and validity of his own wealth.” [2]

To put it concisely: one of Bitcoin’s most attractive qualities, it’s fixed maximum supply, only emerges because the miners have responded to the underlying blockchain’s incentives.

Over the past few years, Bitcoin has inspired the development of thousands of blockchains and blockchain-based protocols. These protocols have evolved the original incentive model, creating new crypto-economic models incentivizing the provision of not only hardware, but also capital assets, and human work and expertise. The applications that result cut across use cases. They include decentralized financial infrastructure, cloud compute and storage platforms, and even platforms for human talent.

Filecoin has incentivized the provision of almost 2 exbibytes of storage (roughly equivalent to 38 copies of the entire Internet Archive) from more than 1,000 storage providers. [3] Aave and Compound have incentivized asset holders to lend more than $6B to be lent out to borrowers. [4] And The Graph has incentivized developers to build, maintain, and curate thousands of open APIs for protocol data. All of these providers are incentivized by protocol-guaranteed compensation in the form of network fees and network ownership, represented by a digital asset.

Looking forward, these incentivization mechanisms have major implications for our economy. Particularly, there are implications for how means of production and creation will be owned and governed, and how wealth will be distributed.

Notice in the descriptions of the applications above - Bitcoin, Filecoin, Compound - there are no Central Banks involved in the administration of bitcoin, no Amazon or Microsoft maintaining the data centers, and no JPMorgan or other bank custodying assets. There is no “firm”.

Coase’s Theory of the Firm states that a firm is formed when the transaction costs of obtaining a good or service from the market are greater than they would be to produce the good or service in-house. Some of these costs include the costs of negotiating and policing bad actors. A firm forms long-term contracts with its employees and suppliers, who are typically paid some fixed fees for their services. The firm is owned by entrepreneurs and executives who direct production and, when the firm is successful, benefit disproportionately.

Blockchains and blockchain-based protocols drastically reduce these transaction costs by writing explicit terms and conditions into the code which interacts with network stakeholders, including suppliers and customers. Bad actors might have some assets “slashed” if they misbehave. Supplier rewards might adjust based upon a chosen lock-up period. If the protocol has succeeded in aggregating supply, a consumer’s demand will never be left unfulfilled.

These protocols have drastically reduced the cost of making a market transaction. It may now make more economic sense to coordinate production and creation via protocol than it does through a firm.

For sure, technologies like the Internet and mobile phones have powered new companies challenging the traditional definition of the “firm” for years. Uber and Airbnb, which coordinate the sale of rides and rooms but own neither, are prime examples of this. [5, 6]

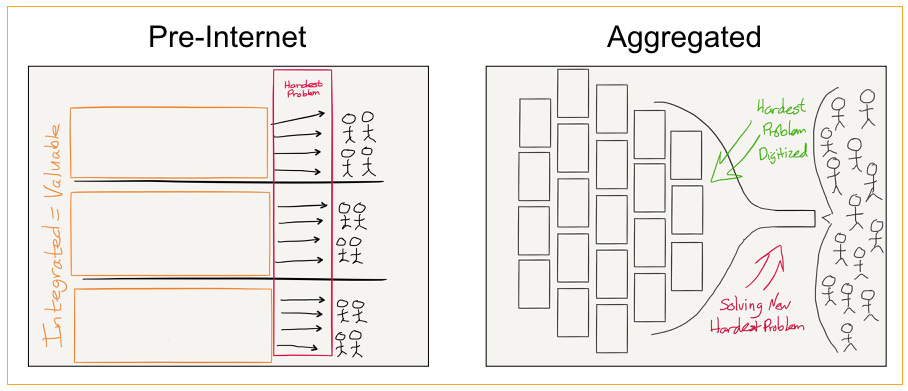

Uber and Airbnb are examples of aggregators, a term coined a few years ago by Ben Thompson on his blog Stratechery. Aggregation Theory goes something like this: the Internet has reduced transaction costs to zero, and allowed for free distribution of digital goods. In a world with commoditized supply, ownership of demand is king. Uber, Airbnb, Facebook and others have built their businesses through aggregating supply (cars, homes, content) and providing the best end user experience to its customers. It wins the most customers, which begins a flywheel that attracts more suppliers, further improving end user experience. Airnb and Uber specifically are noted as commoditizing trust between the customer and service-provider. [7] The relationship with the end user is exclusive to and funneled through the aggregator.

It’s a bit ironic, however, that a technology which has made it cheaper and easier than ever to transact peer-to-peer has created some of the largest and most powerful corporations the world has ever seen. At the same time, the suppliers powering these corporation remain relatively powerless. No driver, host, or content creator programmatically receives ownership or upside in their networks. Nor do they own their network reputation, records, likes, or distribution lists.

Some of these companies seem to recognize the need to more adequately compensate their suppliers with stock. Uber and Lyft both allowed drivers to purchase stock in their IPO - albeit only a minority of their drivers, and in a clunky manner. [8]

They also have no governance power — changes to core network modules like algorithms and pay are made by executives without any contributor input.

Blockchain-based protocols represent a new model. They are designed to be owned and governed by their contributors, with this power represented in the digital asset received through contributing to the network. Transparent and verifiable terms and conditions - trust, you might say - is built into the underlying code. There may be a corporate entity attached to the network, but its ownership and power is often designed to diminish over time. At the same time, strategic decisions including treasury management and code updates over time are controlled by a diverse set of token-holders.

Thinking about this through the lens of Aggregation Theory, what has happened exactly? Supply remains modularized, but in this case the “aggregator” is owned and governed by the supplier rather than a distinct corporate entity. Profit is distributed amongst suppliers rather than siloed to a small set of entrepreneurs and executives who control the aggregator.

And who now controls demand? Consumers are able to connect to the aggregator directly, or through a lite front end built and owned by the aggregator. Applications might be built by competitors upon the underlying open source code as well. But, this approach might be risky from a commercial perspective, as another developer can undercut the application in price easily using the same underlying source code. At a minimum, suppliers will take home a much larger share of upside than they might have in legacy aggregator models.

I’ll note that there are some open questions as to whether Aggregation Theory would apply to some blockchain-based protocols so neatly. For one, Thompson raises questions about whether transaction costs for financial services products (like Compound, Aave, and blockchain-based systems more broadly) can ever truly be zero due to associated regulation. [9] He notes that cryptonetworks’ power “likely be in an application that is completely new, not an imitation [of aggregators] with an inherently worse user experience”. This post, though, was published in early 2018 — decades ago in crypto years, and before the emergence of many of today’s most exciting crypto-economic incentive mechanisms and applications. [10]

Contextually, this is an interesting time for blockchain-based protocols to emerge. Since 1978, CEO compensation has grown 940%, while typical worker compensation has risen only 12%. A large part of this is due to the fact that a majority of CEO compensation is now made up of stock options. [11] This is just one instance of the growing inequality driving populism and unrest globally.

The recent removal of Donald Trump, many of his supporters, and proponents of QAnon across a variety of social media platforms have raised questions about who should be able to make de-platforming decisions. There has been considerable debate around AWS’s decision to effectively bar Parler from the Internet. And retailers have been fleeing AWS for years, looking to avoid doing their cloud-computing business with their largest existential threat. [12] As Thompson noted in a recent blog post on de-platforming, more folks seem to be recognizing that “when push comes to shove, the cloud providers will act in their own interests first”. [13]

Furthermore, US regulatory bodies appear to finally be taking their shot at Big Tech. At the end of last year, the Justice Department sued Google for illegally protecting its monopoly over search and search advertising, and dozens of states and the FTC sued Facebook for engaging in anti competitive behavior.

As Thompson describes in one of his seminal posts on aggregators,

The nature of digital markets is such that aggregators may be inevitable; traditional regulatory relief, like breaking companies up or limiting their addressable markets will likely result in a new aggregator simply taking their place. [14]

If legacy aggregators are taken down by regulators, the new aggregators which take their place will more than likely be blockchain-based.

In 2021, all eyes are on the disproportionate power and wealth of the corporate entities which have taken over the Internet over the past decade. The time is right for a new means by which to coordinate activity on the Internet, in which suppliers and created are rewarded with ownership and control. And this is why Bitcoin represents so much more than a store of value — it represents a monumental transformation in how human activity is coordinated and compensated. And that is something to get excited about.

***

[1] Market Outlook - Macro Perspective. Paul Jones and Lorenzo Giorgianni.

[2] Bitcoin: A Peer-to-Peer Electronic Cash System. Satoshi Nakamoto.

[3] Filfox Filecoin Blockchain Explorer.

[4] DeFi Pulse.

[5] Wall Street Journal. On-Demand Economy Is Reshaping the Firm, and Society as We Know It. Irving Wladawsky-Berger.

[6] 26th European Regional Conference of the International Telecommunications Society (ITS): "What Next for European Telecommunications?". Transaction costs and the sharing economy. Anders Henten and Iwona Windekilde.

[7] Stratechery. Netflix and the Conservation of Attractive Profits. Ben Thompson.

[8] Wall Street Journal. Some Ubers, Lyft Drivers to Get Stock in IPOs. Maureen Farrell.

[9] Stratechery. Trouble at Lending Club, Lending Club and Aggregation Theory, What Went Wrong. Ben Thompson.

[10] Stratechery. More on Chrome and AMP, The Case Against Google, Decentralization and Paradigm Shifts. Ben Thompson

[11] Economic Policy Institute. CEO compensation has grown 940% since 1978. Lawrence Mishel and Julia Wolfe.

[12] Wall Street Journal. Wal-Mart to Vendors: Get Off Amazon’s Cloud. Jay Greene and Laura Stevens.

[13] Stratechery. Internet 3.0 and the Beginning of (Tech) History. Ben Thompson.

[14] Stratechery. Defining Aggregators. Ben Thompson.

Great article, Devin! I really appreciate the parallels you draw between network governance (a la Bitcoin) and the decentralized business models that mimic it (Uber, Airbnb, etc.).

Any thoughts how this could or should be applied to a media business? Spotify and Netflix immediately come to mind, but I wonder how much more opportunity there is out there in other verticals.

Great research and writing